pabxip.online

Tools

Inverse Yield Etf

The average expense ratio is %. Inverse ETFs can be found in the following asset classes: Equity; Currency; Alternatives; Commodities; Fixed Income. The. An inverse ETF attempts to generate a performance which is exactly the opposite of the underlying index. Most leveraged and inverse ETFs “reset” daily, meaning. This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to -1x the daily performance of its underlying benchmark. Performance may be affected by risks that include those associated with foreign and emerging markets, fixed income securities, high-yield and high-risk. Leveraged & Inverse ETFs ; R, Capital TAIEX Daily Inversed -1X ETF ; L, Cathay U.S. Treasury 20+ Year Daily Leveraged 2X ETF ; R, Cathay U.S. As inverse ETFs profit from the underlying assets' loss, they can be risky, but experienced traders use them to gain from market decline. Seeks to provide investments results that inversely correlate, before fees and expenses, to the performance of the high yield bond market. ProShares UltraShort Financials. SKF | ETF · ; Direxion Daily AMZN Bear 1X ETF. AMZD | ETF · ; ProShares UltraShort S&P SDS | ETF · ; Direxion. Inverse bond mutual funds and ETFs seek to generate returns equal to an inverse fixed multiple of short-term returns of a fixed-income index. The average expense ratio is %. Inverse ETFs can be found in the following asset classes: Equity; Currency; Alternatives; Commodities; Fixed Income. The. An inverse ETF attempts to generate a performance which is exactly the opposite of the underlying index. Most leveraged and inverse ETFs “reset” daily, meaning. This ProShares ETF seeks daily investment results that correspond, before fees and expenses, to -1x the daily performance of its underlying benchmark. Performance may be affected by risks that include those associated with foreign and emerging markets, fixed income securities, high-yield and high-risk. Leveraged & Inverse ETFs ; R, Capital TAIEX Daily Inversed -1X ETF ; L, Cathay U.S. Treasury 20+ Year Daily Leveraged 2X ETF ; R, Cathay U.S. As inverse ETFs profit from the underlying assets' loss, they can be risky, but experienced traders use them to gain from market decline. Seeks to provide investments results that inversely correlate, before fees and expenses, to the performance of the high yield bond market. ProShares UltraShort Financials. SKF | ETF · ; Direxion Daily AMZN Bear 1X ETF. AMZD | ETF · ; ProShares UltraShort S&P SDS | ETF · ; Direxion. Inverse bond mutual funds and ETFs seek to generate returns equal to an inverse fixed multiple of short-term returns of a fixed-income index.

The iShares Short Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities one year or. Inverse ETFs · Stubborn Inflation Keeps These Inverse Bond ETFs Elevated · Bond Prices Dipping Offer Opportunities in These 2 ETFs · Falling Gas Prices Could. Leveraged ETPs (Exchanged Traded Products, such a ETFs and ETNs), seek to provide a multiple of the investment returns of a given index or benchmark on a daily. For example, a 2X leveraged S&P ETF held for several days when the S&P has gone up 3% may yield much less than 6% (2 times. 3%), due to daily reset of. Inverse/Short High Yield Bond ETFs seek to provide the opposite daily or monthly return of high-yield or junk bond prices. The funds use futures contracts. JPMorgan Ultra-Short Income ETF ; YTD · 09/11/ at NAV% ; 30 DAY SEC YIELD · 08/31/ %. Unsub% ; YIELD TO WORST · 09/10/ Gross%. Net An inverse ETF is an exchange-traded fund that uses financial derivatives to provide daily returns that are the opposite of the returns provided by the index. Yields have an inverse relation with bond prices – as price increases, yield falls. Also, as investors shift their money to longer term bonds by selling their. A sortable list of Exchange Traded Funds (ETFs) that can be used to short the market or sectors of the market. Consider using them to hedge an existing. The leveraged and inverse ETF utilize derivatives, such as futures contracts and swaps which are subject to market risks that may cause their price to fluctuate. Leveraged and inverse ETFs pursue daily leveraged investment objectives which means they are riskier than alternatives which do not use leverage. They seek. An inverse ETF is an exchange-traded fund that enables investors to profit from a decline in a benchmark index, asset or other ETF. A case for getting off the sidelines and into bond ETFs. Learn about the current yield opportunity in bond markets. READ MORE. The REX AI Equity Premium Income ETF has a gross expense ratio of %. Distributions are not guaranteed. The Distribution Rate and Day SEC Yield is not. An inverse ETF is a fund constructed by using various derivatives to profit from a decline in the value of an underlying benchmark. · Inverse ETFs allow. An inverse exchange-traded fund, or ETF for short, is a special kind of financial vehicle that aims to produce returns that move against the benchmark it tracks. Similarly, inverse ETFs seek to profit from declines in the underlying index, meaning they can perform inversely to the market, but losses can accumulate. Amundi US Treasury 10Y Daily (-2x) Inverse UCITS ETF Acc Capital at pabxip.onlineing in funds entails risk, most notably the risk of capital loss. The value of. Unlike a traditional Standard and Poors Index fund, which would be expected to track an S&P index, inverse and/or leveraged ETF funds, also known as.

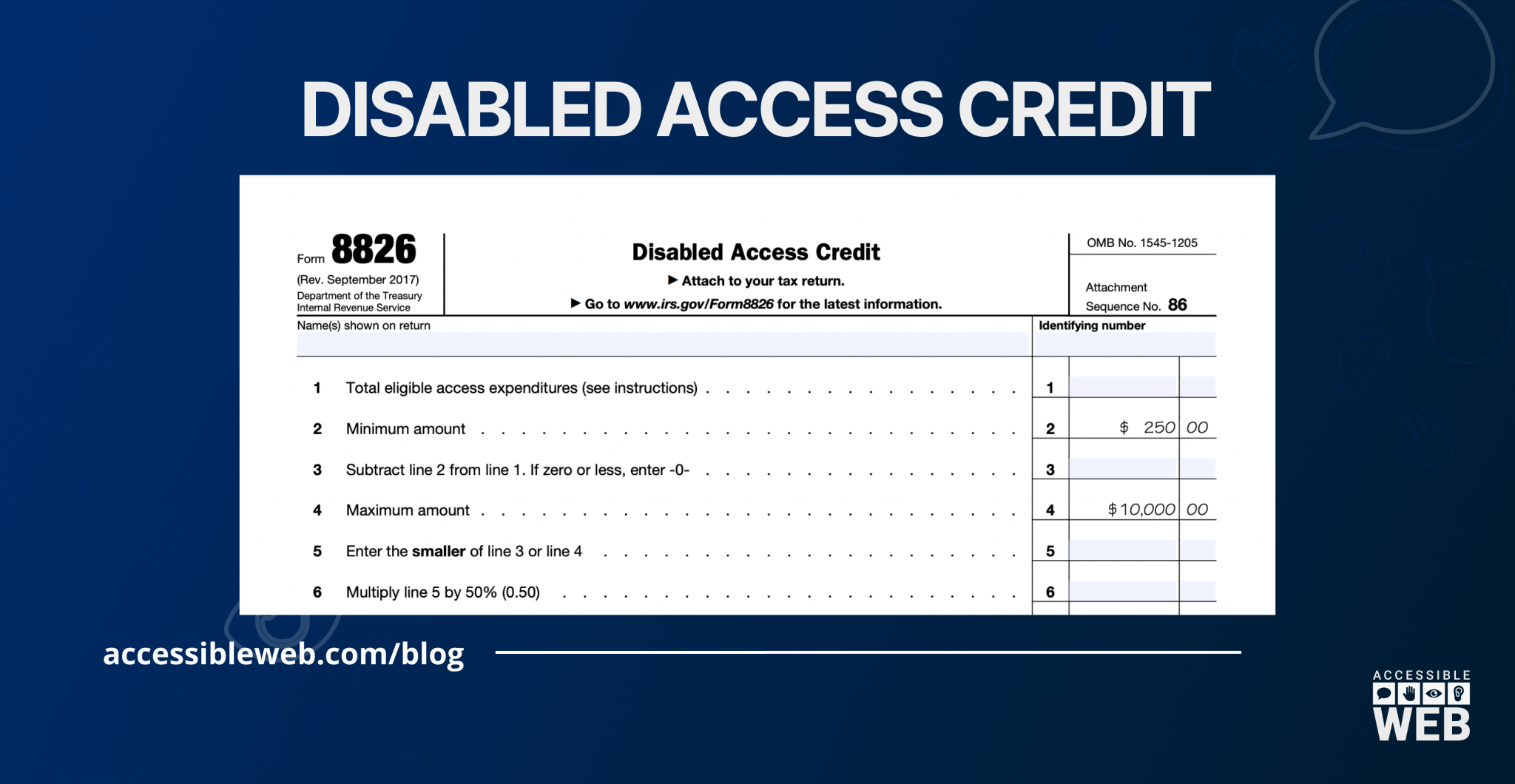

Tax Credit For Ada Compliant Website

Each of these expenditures qualifies under the Disabled Access Credit. To calculate ABC's tax credit, start by adding the total amount spent on accessibility ($. ADA compliance website tax credit covers 50 percent of the total ADA compliance website expenditures you've incurred in a taxable year. With the ADA IRS tax. Learn everything about the ADA tax credit for small businesses. An ADA compliant website can mean tax reductions, legal protection, & better online sales. The ADA Tax Credit is available for one-half the cost of “eligible access expenditures” that are more than $ but less than $10, A full tax deduction, up. Talk to AllyADA Today to Learn More! With this tax incentive, the federal government ensures that the benefits of investing in digital accessibility bring a. Two tax incentives are available to businesses to help cover the cost of making access improvements. The first is a tax credit that can be used for. Eligible small businesses may take a credit of up to $5, (half of eligible expenses up to $10,, with no credit for the first $) to offset their costs. Also, businesses may use the Disabled Tax Credit and the architectural/transportation tax deduction together in the same tax year, if the expenses meet the. under the ADA, nor binding on any agency with enforcement responsibility under the ADA. September 4, ADA. T I T L E I I I. COMPLIANCE MATERIALS. Each of these expenditures qualifies under the Disabled Access Credit. To calculate ABC's tax credit, start by adding the total amount spent on accessibility ($. ADA compliance website tax credit covers 50 percent of the total ADA compliance website expenditures you've incurred in a taxable year. With the ADA IRS tax. Learn everything about the ADA tax credit for small businesses. An ADA compliant website can mean tax reductions, legal protection, & better online sales. The ADA Tax Credit is available for one-half the cost of “eligible access expenditures” that are more than $ but less than $10, A full tax deduction, up. Talk to AllyADA Today to Learn More! With this tax incentive, the federal government ensures that the benefits of investing in digital accessibility bring a. Two tax incentives are available to businesses to help cover the cost of making access improvements. The first is a tax credit that can be used for. Eligible small businesses may take a credit of up to $5, (half of eligible expenses up to $10,, with no credit for the first $) to offset their costs. Also, businesses may use the Disabled Tax Credit and the architectural/transportation tax deduction together in the same tax year, if the expenses meet the. under the ADA, nor binding on any agency with enforcement responsibility under the ADA. September 4, ADA. T I T L E I I I. COMPLIANCE MATERIALS.

Recognizing this, the U.S. government has stepped in to encourage and support ADA-compliant accessibility practices. They've done this by offering a tax credit. What's an ADA Compliant Accessible Website? · The IRS Offers $5, for Website Accessibility with a Special Tax Credit. Introduced in , the ADA compliance tax credit was designed to aid small enterprises in dismantling digital barriers that limit individuals with disabilities. During our webinar, you'll see: But not only does making your site ADA compliant potentially qualify you for a tax credit, it also: And in less than 5. Tax credit for web accessibility expenditures can cover 50% of the eligible access expenditures in a year up to $10,, with the first $ excluded from. Tax Credits are available for up to $6, for the purchase/construction of a new accessible residence and up to 50 percent of the cost of retrofitting existing. Besides your brick-and-mortar store, the ADA tax credit covers a portion of ADA-related expenditures to make your retail website accessible. The ADA tax credit. Are you a small business owner? You may qualify for an IRS tax credit of up to $ to ensure your website is ADA compliant. Learn more from WISE. What if the government paid for half to make your website ADA Compliant? There is a little-known tax credit and tax deduction for Website ADA Compliance. The ADA Compliance Tax Credit provides a significant incentive for clinics to increase accessibility. Suppose you are considering renovating or adding to. The ADA tax credit allows you to get up to $5, in tax credits to make your website accessible for people with disabilities. If you own a business, you may. There is a federal tax credit available to cover 50% of the cost of accessibility upgrades, including consultant costs, for small businesses. Detecting ADA Compliance issues has never been easier than it is now. At Recite Me we offer a free automated scan of your websites homepage. This will identify. What Is The ADA Tax Credit? · Support for Accessibility Investments: If you invest in making your website accessible, you might qualify for this tax credit. · Who. A business that annually incurs eligible expenses to bring itself into compliance with the American Disabilities Act (ADA) may use these tax incentives every. The IRS Offers $5, for Website Accessibility with a Special Tax Credit · The accessibility expense needs to be between $ and $10, for. Get Up to $5, in Tax Credits to make your website accessible. If you own a business, you may have made adjustments to be ADA compliant in the past. The. Small businesses that make website accommodations to improve accessibility for those with disabilities may now be eligible for a tax credit. The ADA Compliance Tax Credit provides a significant incentive for clinics to increase accessibility. Suppose you are considering renovating or adding to. Expenditures must be geared toward ADA compliance and must be reasonable and necessary expenses. Included are amounts related to removing barriers.

Short Term Loans Bad Credit Uk

Frequently Asked Questions On Short Term Loans. Can I get a short-term loan with bad credit? Yes, you absolutely can. However, if you're dealing with a low. As one of the key lenders of short-term loans in the UK, Adage Credit Can I get a short-term loan with bad credit? Yes, you absolutely can. In. Whilst we cannot guarantee your short term loan application will be approved, we won't decline you just for having a low credit score, without first assessing. Omacl have the highest approval rate for short term loans for bad credit. Our application process takes 3 minutes and loans are typically paid out within Is a bad credit short term loan right for me and my situation? For mainstream lenders like banks and building societies, adverse information on your credit file. If approved, you could receive the loan payment today. To be approved you must: Be a UK Resident; Aged 18 or Over; Good or Bad Credit Accepted. Lets get. Looking for short term loans? At Lending Stream, you can apply online and get an almost instant decision. We consider people with bad credit too. If you have a bad credit history and need some credit to bridge a short term gap in your finances then consider these options. Any of Instalment, Doorstep or. When might I need a bad credit loan? · Why are payday loans for poor credit thought of so negatively? · Can I get a payday loan with poor credit? · Will I get. Frequently Asked Questions On Short Term Loans. Can I get a short-term loan with bad credit? Yes, you absolutely can. However, if you're dealing with a low. As one of the key lenders of short-term loans in the UK, Adage Credit Can I get a short-term loan with bad credit? Yes, you absolutely can. In. Whilst we cannot guarantee your short term loan application will be approved, we won't decline you just for having a low credit score, without first assessing. Omacl have the highest approval rate for short term loans for bad credit. Our application process takes 3 minutes and loans are typically paid out within Is a bad credit short term loan right for me and my situation? For mainstream lenders like banks and building societies, adverse information on your credit file. If approved, you could receive the loan payment today. To be approved you must: Be a UK Resident; Aged 18 or Over; Good or Bad Credit Accepted. Lets get. Looking for short term loans? At Lending Stream, you can apply online and get an almost instant decision. We consider people with bad credit too. If you have a bad credit history and need some credit to bridge a short term gap in your finances then consider these options. Any of Instalment, Doorstep or. When might I need a bad credit loan? · Why are payday loans for poor credit thought of so negatively? · Can I get a payday loan with poor credit? · Will I get.

Can I apply for short term loans with bad credit? Yes, whilst many other short term loans direct lenders may not consider your loan application if you have a. If you've struggled to secure credit elsewhere, a bad credit loan from Finio Loans may be a suitable option as it's possible that a low credit rating and poor. Personal loans for bad credit are for people with lower credit scores who need to borrow a larger amount of money at relatively low APR. Personal loans for bad credit are for people with lower credit scores who need to borrow a larger amount of money at relatively low APR. Over 18 years of age · Full-time UK resident · Earning a regular income · Valid UK bank account, mobile phone and email · No guarantor required · Bad credit. Yes, you can borrow a loan with us even if you have a bad credit rating. Quick Loans Express is a no guarantor lender in the UK that believes in giving everyone. Can I get loan with poor credit score? Yes, it's possible to get a loan with a poor credit score. There are lenders who specialise in bad credit loans, though. Do you need money in your account within the hour? Bad credit payday loans can be paid out instantly with Wage Day Advance. Apply now! Are you struggling to get a bad credit loan? We are a direct UK lender Everyday Loans is a good example of a bad credit personal loan provider. You. Bad credit loans are available for consumers with low credit scores. Loans for bad credit are typically offered by online lenders, which provide streamlined. Badger Loans offers Short Term Loans for Bad Credit from £ to £ repaid over 2 to 60 Months. Apply Online with Direct Lenders! Affordable Short Term Loans from Fair Finance a Direct Lender. Bad Credit? Low Income? We Can Help. Short term loans for bad credit are loans designed to help those with low credit scores access short term finance. Usually, those with poor credit might think. loans for bad credit. Apply for a fair £ payday loan today Proud to offer the cheapest instant short term loans in the UK. Compare our loans. Short term loans are a good choice if you require money, fast due to unforeseen circumstances or an emergency. They're also a good option if you have bad credit. Payday Bad Credit offers bad credit loans up to £ repaid over 3 to 9 months. We are a direct lender. Apply online today! £ Loans That Consider Bad Credit It may seem difficult to get loan approval if you have a low credit score. As your credit rating can drop due to reasons. Bad credit loans are unsecured personal loans or payday loans for people in the UK with poor credit scores. Luckily, even if you have a very bad credit score. Loans for bad credit are small, unsecured loan amounts specifically for bad credit customers. These loans range in size with from £ – £1, and much-needed. Yes, it's always good to shop around and compare options, particularly as short-term lending can be a costly way to borrow money. If you have bad credit, those.

2 3 4 5 6